Most major stock markets in the Gulf ended lower on Monday amid a surge in COVID-19 cases, although the Qatari index bucked the trend.

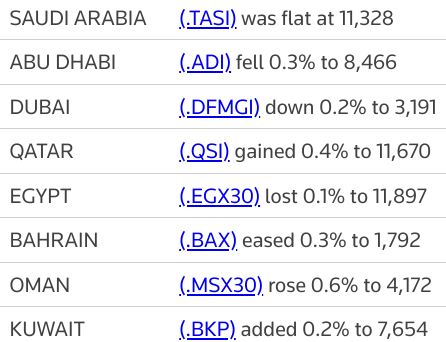

In Abu Dhabi, the index (.ADI) fell 0.3%, with Alpha Dhabi Holding (ALPHADHABI.AD) retreating 3.9% after the conglomerate said it had bought an additional 17% in developer Aldar Properties (ALDAR.AD) to take its stake to 29.8%. read more

Shares of Aldar gained 1%.

Dubai's main share index (.DFMGI) lost 0.2%, hit by a 7.4% slide in bourse operator Dubai Financial Market (DFM.DU).

The United Arab Emirates (UAE), a tourism and commercial hub now marking its peak tourism season and hosting a world fair, on Sunday recorded 2,600 new coronavirus cases and three deaths. It said on Saturday it would ban non-vaccinated citizens from travelling abroad from Jan. 10. read more

Daily cases had fallen below 100 in October.

Separately, the Houthi movement that controls most of northern Yemen has hijacked an UAE-flagged cargo vessel off the Yemeni port city of Hodeidah, the Saudi-led coalition said on Monday, according to TV channel Al Arabiya. read more

The benchmark index (.TASI) in Saudi Arabia, the largest Gulf state with a population of around 30 million, ended flat as gains in financial shares were offset by declines in petrochemical stocks.

Daily coronavirus cases in Saudi Arabia have climbed above 1,000 for the first time since August, after having fallen below 100 in September.

Saudi Arabia's central bank has extended a deferred payment programme meant to help support the private sector by an additional three months until March 31, it said on Thursday. read more

The Qatari index (.QSI), however, gained 0.4%, ending two sessions of losses, helped by a 0.9% gain in petrochemical maker Industries Qatar (IQCD.QA).

Meanwhile, oil rose towards $79 a barrel, supported by tight supply and hopes of further demand recovery in 2022.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased 0.1%, with top lender Commercial International Bank (COMI.CA) losing 0.6%.

The Egyptian market is also exposed to some price corrections after the increases from last week as investors move to secure their gains, said Wael Makarem, senior market strategist at Exness.

No comments:

Post a Comment