A record-breaking number of emerging-market companies made their public debuts in 2021, just ahead of what should be a tough year for equity investors.

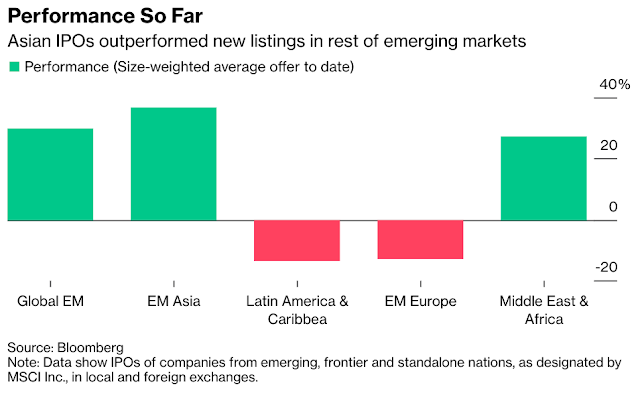

While the price of most newly issued stocks has risen since their IPOs, the benchmark gauge of developing-economy stocks just wrapped up its worst year since 2018. That suggests appetite for the risk assets is dwindling, with quick-spreading virus variants and higher interest rates set to further challenge equities in coming months.

Those headwinds were far from investors’ minds as higher capital needs and hope for a global economic recovery led 1,161 companies from emerging markets to make initial public offerings last year on local or foreign exchanges. All together, they raised $228 billion via listings, a 31% increase from 2020, according to data compiled by Bloomberg.

“Last year, especially in the first half, we saw a boom of tech-related IPOs across EM,” said Ignacio Arnau, a Madrid-based investor at Bestinver Asset Management, which has about $8 billion under management. “There was both fundamental and scarcity value factors driving the appetite in the market.”

No comments:

Post a Comment