Some of the same concerns weighing down global equities have been leading stocks in the Persian Gulf to soar this year.

Elevated commodity prices and higher interest rates have led benchmark indexes of oil and gas-rich countries like Saudi Arabia and Qatar to be among the top 10 performers in the world this year. The MSCI GCC Countries Index is outperforming both developed and emerging market gauges and is set for its best quarter since 2016.Banking and commodity shares have been among the key beneficiaries. Central banks in Saudi Arabia, Qatar, the United Arab Emirates and Kuwait all moved with the Federal Reserve in raising interest rates to protect their currency pegs, providing further support to lenders. And while oil pulled back from higher levels seen at the start of Russia’s invasion of Ukraine, Brent still trades well above the price needed for the region’s biggest economies to generously fill their coffers with cash.

“Oil at above $90 has a significant effect on the fiscal situation as well as liquidity in the system and the region,” Faisal Hasan, chief investment officer at Al Mal Capital, said. “Saudi and UAE are well placed to reap that benefit.”

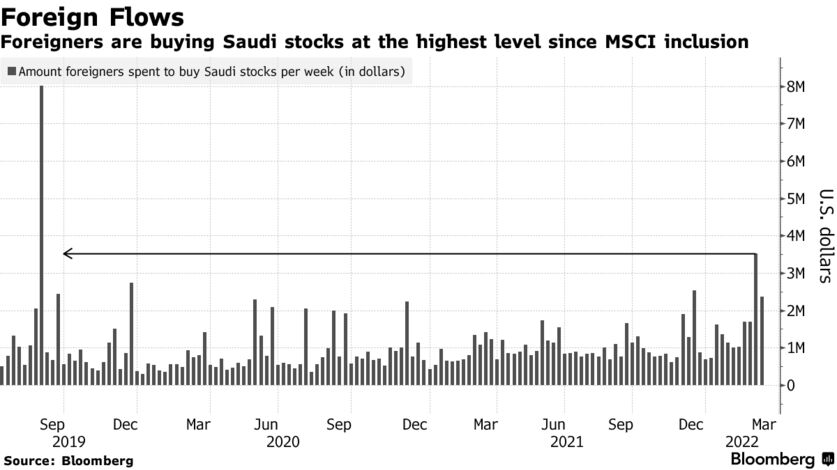

Gulf stock markets are poised for strong growth and higher foreign participation, he said, adding that the region is attracting an increasing number of investors as more companies go public. Foreigners are buying Saudi stocks at the highest rate since the kingdom’s shares were included in the MSCI Emerging Markets Index back in 2019.

The Gulf is a “haven for global investors since the start of the Ukraine-Russia conflict,” said Noaman Khalid, associate director of indices, macroeconomics and strategy at Arqaam Capital. Gulf markets have “multiple layers of support” due to passive flows from global indexes, a strong pipeline of initial public offerings and high commodity prices.

No comments:

Post a Comment