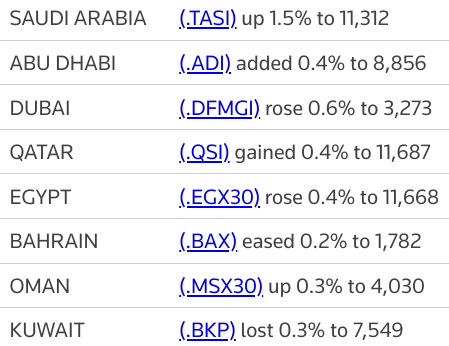

Major stock markets ended higher on Thursday in line with global shares, after the U.S. Federal Reserve said it would end its pandemic-era bond purchases in March and begin raising interest rates as much as three times next year.

Saudi Arabia's benchmark index (.TASI) advanced 1.5%, buoyed by a 2.2% rise in Al Rajhi Bank (1120.SE) and a 6.7% jump in Banque Saudi Fransi (1050.SE).

The Saudi bourse continues its recovery as oil prices inched higher providing support to local stocks, said Wael Makarem, senior market strategist at Exness.

Dubai's main share index (.DFMGI) closed 0.6% higher, rising for an eleventh session in twelve, helped by a 1.1% gain in Emirates NBD Bank (ENBD.DU) and a 0.7% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Investors concentrate on the local fundamentals again expecting solid developments as new initial public offerings (IPO) roll out, said Makarem.

"The bourse could also benefit from the recent changes in trading days starting next month."

Last month, the emirate announced plans for 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market in the region, as bourses in Saudi Arabia and Abu Dhabi see larger listings and strong liquidity.

In Abu Dhabi, the index (.ADI) gained 0.4%, with telecoms firm Etisalat (ETISALAT.AD) rising 1.9% and conglomerate International Holding finishing 2.3% higher.

However, the index saw its first weekly loss in seven.

The Qatari benchmark index (.QSI) added 0.4%, led by a 2% rise in Islamic lender Masraf Al-Rayan (MARK.QA).

The central bank of Qatar said on Thursday it will start working on a gradual reduction of the measures introduced to support the economy given the recovery from the coronavirus crisis in the tiny but wealthy Gulf state. read more

The central bank also said the local financial and banking system was stable and domestic liquidity high.

Outside the Gulf, Egypt's blue-chip index (.EGX30) firmed 0.4%, with Fawry for Banking Technology and Electronic Payment (FWRY.CA) climbing 4%.

No comments:

Post a Comment