Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Wednesday, 31 August 2022

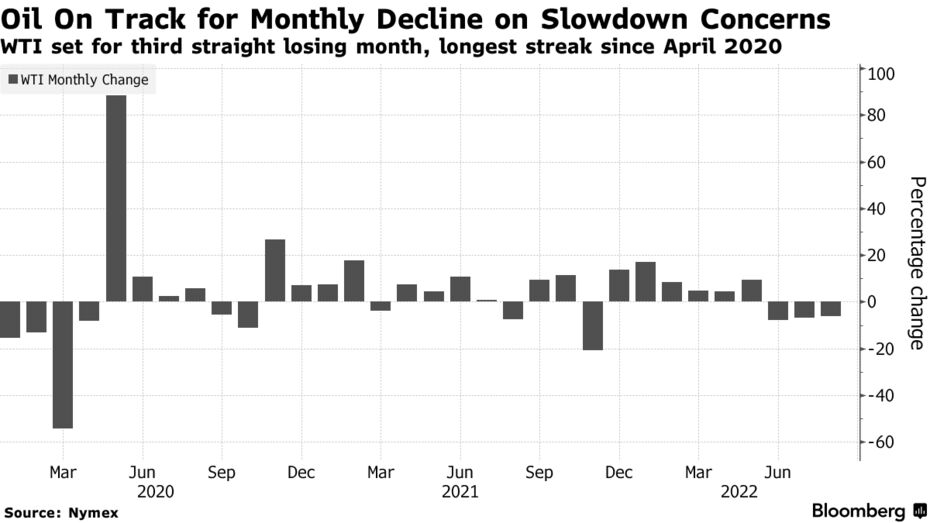

Oil Suffers Worst Losing Run Since 2020 as Slowdown Angst Flares - Bloomberg

Oil headed for a third monthly drop, the longest declining streak in more than two years, on prospects for slower global growth as central banks tighten policy and China presses on with its Covid Zero strategy.

West Texas Intermediate, which traded above $92 a barrel after tumbling on Tuesday, has shed more than 6% in August, hitting the lowest since January mid-month. In the US, the Federal Reserve has been raising rates aggressively to quell inflation, while Europe is gripped by an energy crisis that may herald a recession. In Asia, growth in China, the top oil importer, has slowed.

Traders are also tracking an array of supply-related issues. While there has been significant unrest in both Libya and Iraq in recent days, oil output in both OPEC members appears to be unaffected so far. Separately, talks to revive an Iranian nuclear deal that may unlock greater crude exports have dragged on.

Jefferies Nears Deal to Sell its Oak Hill Capital Stake to #Kuwait-Backed Wafra - Bloomberg

Wafra, an alternative-asset manager that invests on behalf of Kuwait, has agreed to acquire a minority stake in private equity firm Oak Hill Capital Partners from Jefferies Financial Group Inc., according to people with knowledge of the matter.

A transaction may be announced in coming weeks, said one of the people, all of whom requested anonymity as the information is private.

Jefferies and Wafra representatives declined to comment. Oak Hill Capital didn’t immediately respond to a request for comment.

Jefferies bought a 15% stake in Oak Hill Capital in 2019, when the firm planned to make it the anchor investment in a fund managed by Stonyrock Partners. Stonyrock planned to raise as much as $1 billion to buy stakes in private equity, real estate, infrastructure and other asset classes, but Jefferies has since wound down the effort, dubbed Stonyrock Alt Fund I LP. The New York-based lender began exploring a sale of its interest, Bloomberg News reported earlier this year.

Oak Hill Capital traces its roots to Texas billionaire Robert M. Bass’s family office, and is led by managing partners Tyler Wolfram, Brian Cherry and Steve Puccinelli. The firm has raised about $20 billion in capital commitments since its inception, it said last month.

New York-based Wafra, which invests on behalf of sovereign wealth and pension funds, has previously acquired minority stakes in other alternative-asset managers including Thompson Street Capital Partners, TowerBrook Capital Partners, Stone Point Capital and Siris Capital Group.

Capital Constellation, a platform managed by Wafra, has backed smaller firms including Ara Partners, Avista Capital Partners, Pollen Street and All Seas Capital.

Realty, banking blue chips continue to drive #UAE markets

The UAE financial markets on Tuesday posted gains of around AED4.1 billion in market cap fueled by continued upbeat sentiments at the realty and banking sectors and cash inflows by institutions and individuals alike.

Driven by Emaar, Dubai General Index (DFMGI) advanced 0.79 percent to 3,463.5927.16 pts, with the property blue chip closing higher at AED4.80 and AED6.04 for Emaar Development and Emaar Properties respectively.

Among other stocks, Emirates NBD, DEWA, and TECOM increased 0.74 percent, 0.77 percent and 1.25 percent respectively.

Abu Dhabi index (FTFADGI) closed slightly 0.02 percent down to 9970.11 pts affected by conglomerate International Holding Company (IHC.AD), traded as ASMAK, slipping slightly down to AED338.800, after AED302 million of liquidity and NBAD following suit to AED19.560.

Among other stocks, Alpha Dhabi rose 0.17 percent to AED24.240 and Multiply 0.46 percent up to AED2.180 while ADNOC Distribution moved 1.75 down to AED4.490.

Oil crawls back up on signs of firm U.S. fuel demand, weaker dollar | Reuters

Oil prices recovered slightly on Wednesday as data pointed to firm fuel demand in the United States, providing respite after a 5% drop a day earlier on fear of demand suffering from increased China COVID-19 curbs and central bank interest rate hikes.

A slightly weaker U.S. dollar also shored up the market, with oil consequently being cheaper for buyers holding other currencies.

U.S. West Texas Intermediate (WTI) crude futures jumped 90 cents, or 1%, to $92.54 a barrel at 0306 GMT, after sliding $5.37 in the previous session driven by recession fears.

Brent crude futures for October, due to expire on Wednesday, climbed 70 cents, or 0.7%, to $100.01 a barrel, trimming Tuesday's $5.78 loss. The more active November contract was up 96 cents, or 1%, at $98.80 a barrel.

The price swings since the Ukraine conflict began six months ago have rattled hedge funds and speculators and thinned trading, which in turn has made the market whipsaw even more, as seen on Tuesday. read more

Tuesday, 30 August 2022

Oil dives nearly $6 a barrel on demand fears, Iraq exports | Reuters

Oil prices fell nearly $6 a barrel on Tuesday, the steepest decline in about a month, on fears that fuel demand could soften as global central banks hike rates to fight surging inflation, and as unrest in Iraq failed to dent the OPEC nation's crude exports.

Brent crude futures for October settled down $5.78, or 5.5%, at $99.31 a barrel after touching a session low of $97.55 a barrel.

The October contract expires on Wednesday and the more active November contract was at $97.84, down 4.9%.

U.S. West Texas Intermediate crude dropped by $5., or 5.5%, to $91.64.

Inflation is near double-digit territory in many of the world's biggest economies. This could prompt central banks to resort to more aggressive interest rate increases, which could slow economic growth and fuel demand. read more

Russia gives 12.5% stake in Sakhalin Energy to Mitsui unit | Reuters

The Russian government on Tuesday said it approved handing over a 12.5% stake in operator of Russia's Sakhalin 2 liquefied natural gas plant to Dubai-based MIT SEL Investment Ltd, a subsidiary of Japanese trading house Mitsui & Co (8031.T).

The move comes after Russian President Vladimir Putin signed a decree in June, which created a new legal entity Sakhalin Energy LLC to deal with for buyers and shareholders, which apart from Mitsui & Co also include Shell (SHEL.L) and Mitsubishi Corp (8058.T). read more

The decree, which followed Western sanctions imposed on Moscow over what it calls a "special military operation" in Ukraine, indicated the Kremlin will now decide whether the foreign partners can stay.

Earlier on Tuesday, Japan's biggest city gas supplier Tokyo Gas Co Ltd (9531.T) said it signed a long-term contract with Sakhalin Energy LLC to buy liquefied gas. read more

Mideast Diesel Floods Europe in Taster of Trading Without Russia - Bloomberg

Oil refineries in the Middle East are ramping up diesel deliveries to Europe, giving the continent an early glimpse of how it might fare without supplies from Russia.

About about 435,000 barrels a day of diesel-type fuels are expected to arrive at European ports from the Middle East, this month, according to tanker tracking and Vortexa Ltd. data compiled by Bloomberg. That’s the highest since at least the start of 2019.

Europe will ban imports of diesel from Russia starting early February as punishment for the country’s invasion of Ukraine. While that’s still five months away, the restriction will be felt far sooner in the trading market. The measure will create an acute need for deliveries from elsewhere since Russia has long been Europe’s top external supplier.

The “Middle East is likely to be a prime supplier” this winter, said Steve Sawyer, director of refining at industry consultant FGE, who expects European demand to rise year-on-year by then.

Oil slides more than $4 on inflation and Iraq exports | Reuters

Oil prices fell about $4 a barrel on Tuesday on fears that an inflation-induced weakening of global economies would soften fuel demand and as unrest in Iraq has not put a dent in the OPEC nation's crude exports.

Brent crude futures for October settlement were down $4.43, or 4.2%, at $100.62 a barrel by 11:00 a.m. ET (1500 GMT) after touching a session low of $99.66 a barrel.

The October contract expires on Wednesday and the more active November contract was at $99.19, down 3.6%.

U.S. West Texas Intermediate crude dropped by $4.00, or 4.1%, to $93.01.

Inflation is near double-digit territory in many of the world's biggest economies. This could prompt central banks in the United States and Europe to resort to more aggressive interest rate increases, which could slow economic growth and weigh on fuel demand. read more

"Investors are now waiting for the monthly employment data on Friday" said Kunal Sawhney, chief executive of equity researcher Kalkine Group.

Most Gulf bourses in red as oil slide weighs on region | Reuters

Most stock markets in the Gulf ended lower on Tuesday, following a sharp decline in oil prices and worries about a potential global recession.

Crude prices, a key catalyst for the Gulf's financial markets, fell by over $3 a barrel on fears an inflation-induced weakening of global economies would soften fuel demand, and as Iraqi crude exports have been unaffected by clashes.

Brent crude futures for October settlement fell $3.81, or 3.63%, to $101.28 a barrel by 1156 GMT, after hitting a session low of $100.90 a barrel.

Inflation is near double-digit territory in many of the world's biggest economies, a level not seen in close to half a century. This could prompt central banks in the United States and Europe to resort to more aggressive interest rate hikes that could curtail economic growth and weigh on fuel demand. read more

Saudi Arabia's benchmark index (.TASI) declined 0.6%, weighed down by a 2.9% fall in Dr Sulaiman Al-Habib Medical Services (4013.SE) and a 0.6% decrease in Al Rajhi Bank (1120.SE).

The Qatari index (.QSI) eased 0.1%, with Qatar Islamic Bank (QISB.QA) losing 1.3%.

In Abu Dhabi, the index (.FTFADGI) closed flat after a more than 1% decline in the previous session, with the United Arab Emirates' biggest lender First Abu Dhabi Bank (FAB.AD) edging 0.2% higher.

Dubai's main share index (.DFMGI), however, bucked the trend to close 0.8%, buoyed by a 2.7% jump in blue-chip developer Emaar Properties (EMAR.DU).

Outside the Gulf, Egypt's blue-chip index (.EGX30) firmed 0.1%, ending two sessions of losses, helped by a 2.7% rise in Abu Qir Fertilizers (ABUK.CA).

The index, which is down more than 15% so far this year, has come under pressure because of a sharp slide in foreign portfolio investor holdings and rising costs of key commodity imports, especially since Russia's invasion of Ukraine.

Gulf banks with Turkey exposure to suffer further losses, Fitch says | Reuters

Gulf banks with exposure to Turkey are expected to make further net monetary losses on their investments in the second half of this year and into 2023, ratings agency Fitch said on Tuesday.

Gulf banks with Turkish subsidiaries are estimated to have registered $950 million of net monetary losses in the first half of 2022, Fitch said, as they account for their exposure in the currency of a hyperinflation economy.

Fitch said Dubai's Emirates NBD (ENBD.DU) and Kuwait Finance House (KFH.KW) were the worst-affected when looking at the ratings firm's core profitability metric, which is operating profit over risk-weighted assets.

Interest rate cuts under President Tayyip Erdogan's new economic programme saw the lira end last year down 44% against the dollar and shed another 27% so far this year, sending inflation to a 24-year high of nearly 80% in July.

Fintech firm Wise fined $360,000 by #AbuDhabi regulator | Reuters

The regulator of Abu Dhabi's free zone financial centre said on Tuesday it had fined the local subsidiary of fintech firm Wise $360,000 for breaching anti-money laundering (AML) requirements.

Abu Dhabi Global Market's Financial Services Regulatory Authority (FSRA) "found that Wise did not establish and maintain adequate AML systems and controls to ensure full compliance with its AML obligations", it said in a statement.

Wise said in response to a Reuters query that it takes its responsibility to protect its customers and prevent money laundering "very seriously", and that neither the FSRA nor the company had identified instances of money laundering or other financial crimes.

The FSRA also said its review had not found instances of actual money laundering as a result of Wise's AML systems and control failures.

It said breaches by Wise Nuqud included it failing to identify and verify the source of funds or wealth held by some customers it had identified as high risk before carrying out transactions on their behalf.

Oil falls by over $3 on inflation woes, Iraq exports | Reuters

Oil prices fell by more than $3 a barrel on Tuesday on fears that an inflation-induced weakening of global economies would soften fuel demand, and as Iraqi crude exports have been unaffected by clashes.

Brent crude futures for October settlement fell $3.81, or 3.63%, to $101.28 a barrel by 1156 GMT, after hitting a session low of $100.90 a barrel.

The October contract expires on Wednesday and the more active November contract was at $100.01 a barrel, down 2.84%.

U.S. West Texas Intermediate crude was at $94.12 a barrel, down $2.89, or 2.98%.

Inflation is near double-digit territory in many of the world's biggest economies, a level not seen in close to a half century. This could prompt central banks in the United States and Europe to resort to more aggressive interest rate hikes that could curtail economic growth and weigh on fuel demand. read more

"The economy will continue to remain slow with the Fed’s aggressive monetary policies. Investors are now waiting for the monthly employment data on Friday," said Kunal Sawhney, chief executive officer, Kalkine Group.

Mideast Stocks: Gulf markets rebound after overnight jump in oil prices

Gulf stock markets inched higher on Tuesday, as an overnight jump in crude oil prices outweighed concerns over tightening global monetary policies.

Oil prices jumped more than 4% on Monday, extending last week's gains after Saudi Arabia raised the prospect of the Organization of the Petroleum Exporting Countries and allies cutting output when they meet on Sept. 5.

The move is designed to balance the market in response to a potential supply boost from Iran should it hammer out a nuclear deal with the West.

Gains in the Gulf markets were capped by rising prospects of a slower global economic growth after U.S. Federal Reserve and European Central Bank officials adopted a more hawkish stance to combat a runaway inflation.

Saudi Arabia's benchmark index traded 0.4% higher, led by financial and energy stocks. Oil giant Saudi Aramco rose 0.7% and Al Rajhi Bank added 0.4%.

Saudi Steel Pipes soared nearly 5% and was the top percentage gainer on the index after the manufacturer bagged a new order for oil and gas steel pipes.

The Dubai index climbed 0.5%, recouping most of the losses suffered on Monday when investors turned bearish on tighter monetary policy outlook.

The gains were led by real estate stocks. Emaar Properties , the emirate's largest developer, jumped 1.5%.

Shares in Abu Dhabi also rose after a more than 1% decline in the previous session, with heavyweight lender First Abu Dhabi Bank edging 0.4% higher.

The Qatar index gave up early gains, with energy and industrial stocks trading sideways.

Oil tumbles on inflation woes, Iraq exports | Reuters

Oil prices fell Tuesday on fears that an inflation-induced weakening of global economies would soften fuel demand, and as Iraqi crude exports have been unaffected by clashes.

Brent crude futures for October settlement fell $2.45, or 2.33%, to $102.64 a barrel by 1022 GMT, after climbing 4.1% on Monday, the biggest increase in more than a month.

The October contract expires on Wednesday and the more active November contract was at $101.12 a barrel, down 1.76%.

U.S. West Texas Intermediate crude was at $95.46 a barrel, down $1.55, or 1.6%, following a 4.2% rise in the previous session.

Inflation is near double-digit territory in many of the world's biggest economies, a level not seen in close to a half century. This could prompt central banks in the United States and Europe to resort to more aggressive interest rate hikes that could curtail economic growth and weigh on fuel demand. read more

#Dubai School Operator Taaleem Holdings Pushes Ahead With IPO - Bloomberg

Shareholders on Monday approved the conversion of Taaleem from a private joint stock company into a public entity through the IPO, according to an advertisement in Gulf News. A book-building process will follow.

Even as share sales globally plummeted from their record levels of last year, the oil-rich Gulf has been in the midst of an unprecedented IPO boom as high oil prices and equity inflows buoyed local markets. However, concerns that the economy is slowing because of aggressive monetary policy tightening have weighed on both crude and regional indexes.

Taaleem, which offers British and American curricula as well as the International Baccalaureate, has picked EFG-Hermes and Emirates NBD Bank to lead the IPO, Bloomberg reported in April.

Oil edges down as inflation expected to impact fuel demand | Reuters

Oil prices dipped on Tuesday, paring some gains from the previous session, as the market feared that more aggressive interest rates hikes from central banks may lead to a global economic slowdown and soften fuel demand.

Brent crude futures for October settlement dropped 56 cents, or 0.5%, to $104.53 a barrel by 0620 GMT, after climbing 4.1% on Monday, the biggest increase in more than a month.

The October contract expires on Wednesday and the more active November contract was at $102.57, down 0.4%.

U.S. West Texas Intermediate crude was at $96.86 a barrel, down 14 cents, or 0.1%, following a 4.2% rise in the previous session.

Inflation is near double-digit territory in many of the world's biggest economies, a level not seen in close to a half century, which could prompt central banks in the United States and Europe to resort to more aggressive interest rate hikes. read more

Monday, 29 August 2022

Oil settles up more than 4% on prospect of OPEC+ supply cut | Reuters

Oil prices settled up more than 4% on Monday, extending last week's gain, as potential OPEC+ output cuts and conflict in Libya helped to offset a strong U.S. dollar and a dire outlook for U.S. growth.

Saudi Arabia, top producer in the Organization of the Petroleum Exporting Countries (OPEC), last week raised the possibility of production cuts, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West. read more

OPEC+, comprising OPEC, Russia and allied producers, meets to set policy on Sept. 5.

Brent crude settled up $4.10, or 4.1%, at $105.09 a barrel, having risen by 4.4% last week. U.S. West Texas Intermediate (WTI) crude gained $3.95, or 4.2%, to$ 97.01, after rallying 2.5% last week.

"Oil prices are inching higher on hopes of a production cut from OPEC and its allies to restore market balance in response to the revival of Iran's nuclear deal," said Sugandha Sachdeva, vice president of commodity research at Religare Broking.

Oil Rises as Musk, Van Beurden Warn of Energy Supply Challenges - Bloomberg

Oil climbed as traders weighed supply risks and executive warnings of further energy crunches against central bank pledges to raise interest rates further.

West Texas Intermediate rose above $94 a barrel after gaining 2.5% last week. In Libya, clashes between militias in the capital left at least 23 dead, sparking fears of further upheaval in the OPEC nation. While Libya’s output so far remains stable, investors are watching for signs that the violence may again put oil shipments at risk just as Europe reels from an energy crisis.

It’s a “fantasy” that the global energy crunch will be easy to overcome, Ben Van Beurden, chief executive officer of oil and gas giant Shell Plc, said at a conference in Norway. Speaking at the same event, Tesla Inc. CEO Elon Musk said the world needs more oil and gas now while also pushing to transition to renewable supplies.

Iran, meanwhile, said exchanges with the US over a European Union proposal to revive a nuclear deal will drag on into next month, undercutting speculation that an agreement paving the way for increased oil flows is imminent.

#Dubai Diamond Exchange sees trade worth $19.8 bln in first half of year -DMCC Chairman | Reuters

Around $19.8 billion worth of diamonds have been traded through the United Arab Emirates in the first half of 2022, the head of the Dubai Multi Commodities Centre (DMCC) said on Monday, a 24.7% increase year-on-year.

Dubai has grown its diamond industry by leveraging its proximity to Africa and Russia, where many diamonds are mined, and India, where 90% of the world's diamonds are polished.

DMCC Chief Executive Ahmed Bin Sulayem said, "business owners from all countries are welcome equally to conduct their business in what is one of the safest environments of its kind."

The polished diamond trade in the Gulf state increased 52.5% from a year ago, with a gross trade of $6.7 billion, while the value of rough diamonds traded in the first half of 2022 was $13 billion, he said.

Since its establishment in 2012, 90 billion carats of polished diamonds and 120 billion carats of rough diamonds have been traded through the Dubai Diamond Exchange, housed in the DMCC.

Mideast Stocks: Most Gulf markets in red on rate hike fears

Most stock markets in the Gulf finished lower on Monday, as the growing risk of more aggressive interest rate hikes in the United States and Europe spooked investors.

Federal Reserve Chair Jerome Powell, speaking at the Jackson Hole symposium on Friday, said the Fed would raise rates as high as needed to restrict growth, and keep them there "for some time" to bring down inflation running well above its 2% target.

Most Gulf Cooperation Council countries have their currencies pegged to the U.S. dollar and broadly follow the Fed's policy moves, exposing the region to a direct impact from monetary tightening.

In Abu Dhabi, the index dropped 1.1%, dragged down by a 3% slide in the United Arab Emirates' biggest lender First Abu Dhabi Bank. Dubai's main share index closed 0.8% lower, hit by a 1% fall in blue-chip developer Emaar Properties and a 1% decline in sharia-compliant lender Dubai Islamic Bank.

European Central Bank board member Isabel Schnabel added to market jitters. On Saturday, she warned that central banks risk losing public trust and must act forcefully to curb inflation, even if that drags their economies into a recession.

Saudi Arabia's benchmark index gave up early gains to end flat. Oil edged higher to extend last week's gains as potential OPEC+ output cuts and conflict in Libya helped to offset a strong U.S. dollar and a dire outlook for U.S. growth. Saudi Arabia, top producer in the Organization of the Petroleum Exporting Countries (OPEC), last week raised the possibility of production cuts, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West.

Outside the Gulf, Egypt's blue-chip index lost 0.6%, with Madinet Nasr For Housing And Development retreating about 7%.

#Saudi's Alfanar to build $3.5 bln green hydrogen project in Egypt | Reuters

Saudi Arabian company Alfanar said on Monday it has signed a memorandum of understanding to build a $3.5 billion green hydrogen project in Egypt.

The facility will produce 500,000 tonnes of green ammonia, which is used in agricultural fertilisers, from 100,000 tonnes of green hydrogen per year.

The project is among seven MOUs signed last week between Egypt and international companies, including Globeleq and Actis, to set up green hydrogen and ammonia production facilities in the Egyptian town of Ain Sokhna.

Egypt, the host of the upcoming COP27 UN Climate Change Conference, has been trying to position itself as a regional hub for green fuel production. The country has signed a number of MOUs in the past few months including for an $8 billion green hydrogen factory in the Suez Canal Economic Zone. Details such as launch dates have not been disclosed.

Alfanar builds power generation and transmission projects, including renewable power. It operates a 50MW solar project in the Benban Solar Park in Egypt's Aswan.

Oil edges higher on prospect of OPEC+ supply cut | Reuters

Oil edged higher on Monday to extend last week's gains as potential OPEC+ output cuts and conflict in Libya helped to offset a strong U.S. dollar and a dire outlook for U.S. growth.

Saudi Arabia, top producer in the Organization of the Petroleum Exporting Countries (OPEC) last week raised the possibility of production cuts, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West. read more

Brent crude was up 13 cents, or 0.1%, at $101.12 a barrel by 1150 GMT, having risen by 4.4% last week. U.S. West Texas Intermediate (WTI) crude was up 10 cents, or 0.1%, at $93.16 after gaining 2.5% last week.

"Oil prices are inching higher on hopes of a production cut from OPEC and its allies to restore market balance in response to the revival of Iran's nuclear deal," said Sugandha Sachdeva, vice president of commodity research at Religare Broking.

How policy changes are ushering in a new era for the #UAE’s LNG sector

It is one of only five countries that exports and imports liquefied natural gas (LNG) — the others have far-flung territories that need tankers to transfer gas between them. But policy changes in recent years will help to resolve those paradoxes and move the nation’s gas business into a new era.

Much of the UAE’s gas production, which is associated with oil output, is inflexible. Demand varies widely by season, while oil production can be curtailed by factors such as commitments under the Opec+ agreement.

Until the start-up of nuclear and solar power in recent years, the country was almost entirely reliant on gas for generating electricity, while it is also a fuel and feedstock for industries such as petrochemicals.

The strong economic and population growth over the past two decades led to surging demand, outstripping, at least temporarily, the amount that could be produced domestically.

In July 2007, Dolphin Energy, which is majority-owned by Mubadala, began delivering gas to the UAE by pipeline from Qatar.

Mideast Stocks: Gulf markets mixed as firmer oil prices counter global outlook

Stock markets in the Gulf were mixed on Monday after firmer oil prices, a key catalyst for financial markets in the Middle East, partially countered heightened risks of a more hawkish monetary policy in the United States and Europe.

European Central Bank board member Isabel Schnabel urged central banks to act forcefully to combat inflation even at the risk of economies sliding into recession, doubling down on comments by Federal Reserve Chair Jerome Powell signalling a tight policy ahead.

Most markets in the region traded on the back foot in the previous session in anticipation of a watered-down global growth as priorities shifted from supporting economy to combating decades-high inflation.

Most Gulf Cooperation Council countries have their currencies pegged to the U.S. dollar and broadly follow the Fed's policy moves, exposing the region to a direct impact from monetary tightening.

The Abu Dhabi index dropped 0.7% of its value in its first session following comments in support of a tighter monetary policy. The lenders led slide with First Abu Dhabi Bank and Abu Dhabi Islamic Bank shedding 1.7% and 1.2%, respectively.

Banks also drove Dubai's index lower, dragged down by a 0.8% fall in Dubai Islamic Bank and a 0.6% drop in Emirates NBD.

Saudi Arabia's benchmark index, however, rebounded from Sunday's slide as buoyant oil prices offset the impact from tight monetary policy outlook.

Oil prices rose after Saudi Arabia and other members of the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, signalled that they could cut output in order to balance the market.

The 0.4% rise in Saudi stocks was driven mainly by financial stocks, with Al Rajhi Bank up 0.2% and Alinma Bank gaining 0.9%.

The Qatar index traded flat earlier in the day, with financials and industrial stocks pulling the market in opposite directions.

Oil rises on prospect of OPEC+ supply cut | Reuters

Oil rose almost 1% on Monday as potential OPEC+ output cuts and conflict in Libya helped to offset a strong U.S. dollar and a dire outlook for U.S. growth.

Saudi Arabia, de facto leader of the Organization of the Petroleum Exporting Countries (OPEC) last week raised the possibility of production cuts, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West. read more

Brent crude rose 65 cents, or 0.6%, to $101.64 a barrel by 0815 GMT, extending last week's 4.4% gain. U.S. West Texas Intermediate (WTI) crude was up $1.22, or 1.3%, at $94.28 after rising by 2.5% last week.

"Oil prices are inching higher on hopes of a production cut from OPEC and its allies to restore market balance in response to the revival of Iran's nuclear deal," said Sugandha Sachdeva, vice president of commodity research at Religare Broking.

#Iran May Drain Offshore Crude Oil Cache If Nuclear Deal Reached - Bloomberg

Progress toward an Iranian nuclear deal has thrown the spotlight onto a sizeable cache of crude held by Tehran that could be swiftly dispatched to buyers in the event an agreement gets hammered out.

About 93 million barrels of Iranian crude and condensate are currently stored on vessels in the Persian Gulf, off Singapore and near China, according to ship-tracking firm Kpler, while Vortexa Ltd. estimates the holdings at 60 to 70 million barrels. In addition, there are smaller volumes in onshore tanks.

“Iran has built up a sizable flotilla of cargoes that could hit the market fairly soon,” said John Driscoll, chief strategist at JTD Energy Services Pte. Still, it may take “a bit of time” to iron out insurance and shipping issues, as well as spot and term sales post-sanctions, he said.

The possible full readmittance of Iran to the global crude market, with the potential lifting of US sanctions, comes at complex moment for oil traders. Investors are juggling the countdown toward far tighter European Union curbs on Russian crude flows from December as part of the the bloc’s pushback against the war in Ukraine. In addition, the Biden administration’s mammoth sale from the Strategic Petroleum Reserve will end in October.

Oil rises on prospect of OPEC supply cut, demand growth | Reuters

Oil prices rose 1% on Monday, as expectations that OPEC would cut output if needed to support prices, coupled with conflict in Libya and rising demand amid soaring natural gas prices in Europe, helped offset a dire outlook for U.S. growth.

U.S. West Texas Intermediate (WTI) crude futures were up 45 cents, or 0.48%, to $93.51 a barrel by 0632 GMT, adding to a gain of 2.5% last week.

Brent crude futures rose 16 cents, or 0.16%, to $101.15 a barrel, extending last week's gain of 4.4%.

"Oil prices are inching higher on hopes of a production cut from OPEC and its allies to restore market balance in response to the revival of Iran's nuclear deal," said Sugandha Sachdeva, vice president of commodity research at Religare Broking.

Strong U.S. oil exports and a bigger-than-expected draw of oil inventory in the last couple of weeks have also eased some demand concerns amid slowdown fears, Sachdeva added.

Sunday, 28 August 2022

Gulf stocks fall on tight monetary policy outlook | Reuters

Major Gulf stock markets ended lower on Sunday as investors in the region reacted to comments by Federal Reserve Chair Jerome Powell signalling the U.S. economy would need tight monetary policy "for some time" to bring inflation under control.

Following in their global peers' footsteps, Gulf markets came under downward pressure as investors worried about a grimmer growth outlook amid a more hawkish policy stand from U.S. Fed chief.

"His comments were more bullish than anticipated by investors and signalled that the central bank is not considering suspending the tightening cycle prematurely even with the decline in inflation in the U.S.," said Farah Mourad, Senior Market Analyst of XTB MENA.

"The central bank's tone could fuel risk aversion among international investors and push them away from other markets," Mourad added.

Saudi Arabia's benchmark index (.TASI) dropped 0.5%, mostly pressured by lenders as almost all fell into negative territory. Al Rajhi Bank (1120.SE) shed 1.4% and Saudi National Bank (1180.SE) sagged 1.3%.

Most Gulf Cooperation Council countries, including the kingdom, have their currencies pegged to the dollar and generally follow the Fed's policy moves, exposing the region to a direct impact from monetary tightening there.

The oil giant Saudi Aramco (2222.SE) retreated 1.7% as a slowdown in global growth may potentially cut oil demand.

Financial stocks also pulled the Qatar index (.QSI) 0.4% lower, with the Gulf's largest lender Qatar National Bank (QNBK.QA) dropping 1.4%.

World Cup Fever Spreads From #Qatar in Middle East Tourism Boom - Bloomberg

An accommodation squeeze and low tolerance for alcohol and partying in the conservative Muslim nation means tens of thousands of fans will base themselves in nearby countries for the monthlong tournament. Match-day flights from major Middle Eastern cities will shuttle spectators to games, benefiting airlines, hotels and hospitality venues across nations including the United Arab Emirates, Saudi Arabia and Oman.

Gulf Tourism

UAE leads annual visitors

Source: World Bank figures as of 2019

The already popular tourism hub of Dubai stands to benefit the most. Of the more than 90 new flights that will land each day in the host city, Doha, about 40 will leave from the UAE. A new hotel built on an artificial, palm-shaped island has been set aside for guests who plan to base themselves in Dubai and take the 40-minute flight to Doha with streamlined immigration procedures.

Dubai will be “the major gateway” to the World Cup with probably more people coming through the city than Qatar, said Paul Griffiths, the chief executive officer of Dubai Airports. “The amount of hotel capacity in Qatar is fairly limited and we’ve got so much to offer here.”

Qatar has been preparing to host the Cup for 12 years and estimates the influx of 1.2 million visitors will add $17 billion to its economy. Amid concerns of an accommodation crunch, organizers have leased two cruise ships and will pitch more than 1,000 tents in the desert. A regional shuttle service will connect Doha with other cities including Muscat, Riyadh, Jeddah and Kuwait City.

Oil Market Volatility: OPEC Wants Higher Oil Prices, Considers Output Cuts - Bloomberg

Saudi Arabia’s Energy Minister Prince Abdulaziz Bin Salman Al Saud is no slouch when it comes to moving the oil market. A few well-chosen words and a hint of output cuts to come — and Brent is back above $100 a barrel within little more than 24 hours. But I’m puzzled by his most recent logic.

The minister appears to be laying the blame for oil’s retreat from its recent highs on the very same people his predecessors blamed for past moves in the opposite direction. The most likely truth is that the kingdom just wants higher oil prices.

This is what he said: “The paper oil market has fallen into a self-perpetuating vicious circle of very thin liquidity and extreme volatility.”

What he means is that there aren’t enough people trading in the futures markets for oil. That’s an odd thing for a Saudi oil minister to suggest. Who does he want to be more active in trading oil futures?

#Qatar Investment Authority in talks for stakes in Alexandria Containers, Eastern Company

The Qatar Investment Authority is negotiating with the Egyptian government for stakes in the Alexandria Container & Cargo Handling Company and the Eastern Company, sources close to the matter revealed to Daily News Egypt.

The authority aims to take 10 to 20% of the shares owned by the Holding Company for Maritime and Land Transport, which currently amounts to about 35%.

The deals are expected to be implemented by the end of this week.

The sources added that Emir of Qatar Tamim bin Hamad Al-Thani is also expected to visit Egypt sometime in the next few weeks, after which, investments worth $20 billion will be announced, some of which will be pumped into estates and green energy projects, in addition to memoranda of understanding.

The sources indicated that the agency is also interested in investing in a number of non-government-owned companies, especially Cairo Investments.

#Saudi pilgrimage complex developer converts $1.4 billion debt to equity | Reuters

Jabal Omar Development Company (4250.SE), one of Saudi Arabia's largest listed property developers, said on Sunday it has reached an agreement with one of its debt holders to convert 5.3 billion riyals ($1.41 billion) of debt into new shares.

Jabal Omar Development (JODC) said it will issue more than 225 million new shares "and in exchange will extinguish all debts" it owes to the Alinma Makkah Real Estate Fund and "settle all rights and obligations related to the Fund."

Advertisement · Scroll to continue

The company operates the Jabal Omar complex of hotels and residential and commercial property within walking distance of the Grand Mosque in the Muslim holy city of Mecca. It was hard-hit when the pandemic curtailed pilgrimages.

Saturday, 27 August 2022

#UAE stocks gain $2.26bln on Friday

The UAE financial markets on Friday posted gains of around AED8.3 billion in market cap driven by upbeat sentiments at the realty, banking and telecom sectors and cash inflows by institutions and individuals alike.

Realty and banking blue chips accounted for the lion's share of transactions that amounted to more than 14,700 worth around AED1.67 billion over 353.7 million shares.

Dubai General Index (DFMGI) advanced 0.007 percent to 3,462.890 pts as blue-chip developer Emaar properties continued to hike, closing higher at AED6.100 after drawing AED155.9 million in cash flows.

Among other stocks, Emirates NBD, Dubai Islamic Bank, and TECOM increased 1.84 percent, 0.84 percent and 0.41 percent respectively.

Abu Dhabi index (FTFADGI) rose 0.133 percent to 10,035.060 pts, with conglomerate International Holding Company (IHC.AD), traded as ASMAK, closing slightly down at AED341.00, after AED312 million of liquidity and NBAD edging higher to AED20.200.

Among other stocks, Abu Dhabi Islamic Bank rose 1.32 percent to AED9.200 and ADNOC Distribution moved higher to AED4.690.

Oil Posts Weekly Gain as #Saudi Warning Lingers Over Market - Bloomberg

Oil rose this week with Saudi Arabia’s warning that supply cuts may be warranted overshadowing multiple bearish developments.

West Texas Intermediate futures settled at $93.06 a barrel on Friday for a 2.5% weekly gain. Prices have been buoyed since the Saudi oil minister said the OPEC+ alliance may limit production to stabilize a volatile market. Meanwhile, the US central bank probably will continue raising interest rates to combat inflation, Federal Reserve Chair Jerome Powell signaled. Higher rates are typically seen as damaging to energy demand.

“Powell reminded Wall Street that restrictive policy is required but we are not there yet, so recession fears and a deteriorating crude demand outlook is not warranted yet,” said Ed Moya, senior market analyst at Oanda.

Oil has lost almost a quarter of its value since June on escalating concerns over a global economic slowdown, but seems to have found a floor around $90 a barrel this month. The prospect of a revived nuclear deal with Iran, which could lead to a surge in crude exports, has added to bearish sentiment recently.

With inflation still rampant, Fed officials revived concerns Friday that they would take continue to move aggressively to slow the economy.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time,” Powell said in remarks prepared for a policy forum in Jackson Hole, Wyoming. “The historical record cautions strongly against prematurely loosening policy.”

Friday, 26 August 2022

Oil prices rise on signals OPEC might cut output | Reuters

Oil prices ended higher on Friday, boosted by signals from Saudi Arabia that OPEC could cut output, but trading was volatile as investors digested and ultimately shrugged off warnings from the head of the U.S. Federal Reserve about economic pain ahead.

Brent crude futures rose $1.65 to settle at $100.99 a barrel. U.S. West Texas Intermediate (WTI) crude futures rose 54 cents to settle at $93.06 a barrel. Both contracts rose and fell by $1 throughout the session.

Overall, Brent gained 4.4% for the week, while WTI was set to rise 2.5%.

The United Arab Emirates became the latest OPEC+ member to state it is aligned with Saudi Arabia's thinking on crude markets, a source with knowledge of the matter told Reuters. read more

On Monday, Saudi Arabia flagged the possibility of production cuts to offset the return of Iranian barrels to oil markets should Tehran clinch a nuclear deal with the West. read more

#SaudiArabia sends message to Biden on oil | Financial Times

UMNO's Silence Over Kuwaiti Hoard Signals Further Cover-Up | Sarawak Report @sarawak_report #Kuwait

Important news emerging from Kuwait over the past few days has so far gone unremarked in KL.

This despite the fact that it concerns the disposal of nearly two billion dollars of stolen Malaysian money – money first reported to be hidden in the gulf state by Sarawak Report back in 2020.

After two years of investigations by the anti-money laundering authorities in that country, which sources say have been hugely frustrated by a lack of Malaysian official cooperation following the fall of the PH government, it has been announced that a court case will open on September 13th relating to the frozen cash.

Once again the misappropriated millions lead right back to the web of criminality around the former UMNO prime minister Najib Razak (now finally jailed this week) acting through his catspaw Jho Low.

In the dock will be three Kuwaiti nationals accused of entering into a scheme to help Najib steal the cash from Malaysian public funds, first in the guise of funding the planned East Coast Rail Link and then two oil pipe lines which were never built.

The defendants are the powerful son of the former Kuwaiti prime minister who was in office at the time, Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah, his lawyer Saud Abdelmohsan and an old college friend of Jho Low, Hamad al Wazzan, who is understood to have connected the Malaysian fraudster to powerful figures in Kuwait.

According to local media the three have been released on bail of 50,000 dinars (RM725,000) each after months of investigations.

#Dubai’s Most Expensive House Buyer Revealed: Indian Tycoon Mukesh Ambani - Bloomberg

Mukesh Ambani’s Reliance Industries Ltd. is the mystery buyer of an $80 million beach-side villa in Dubai, the city’s biggest ever residential property deal, two people familiar with the deal said.

The property on Palm Jumeirah was purchased earlier this year for Ambani’s youngest son, Anant, one of the people said, asking not to be named as the transaction is private. The beach-side mansion sits in the northern part of the palm-shaped artificial archipelago and has 10 bedrooms, a private spa, and indoor and outdoor pools, local media reported without saying who the buyer is.

Dubai is emerging as a favorite market for the ultra-rich, whom the government has actively courted by offering long-term “golden visas” and relaxing curbs on home ownership for foreigners. British footballer David Beckham with his wife Victoria and Bollywood mega star Shahrukh Khan will be some of Ambani’s new neighbors.

Anant is one of three heirs to Ambani’s $93.3 billion fortune, according to the Bloomberg Billionaires Index. The world’s 11th richest person, now 65-years-old, is slowly handing the reins to his children after a diversification push that expanded his empire into green energy, tech and e-commerce.

Al Habtoor Group's revenue surges 19% for H1

Al Habtoor Group (AHG), a UAE-based diversified business conglomerate, has announced a robust performance for the first half of 2022 for the group, registering a 19% growth in company revenue compared to last year in addition to 36% jump in ebitda.

Announcing the results, AHG Founding Chairman Khalaf Ahmad Al Habtoor said: "We had a good year in 2021 where we saw a very promising recovery post-Covid, and I predicted last November an even better 2022. I am delighted to announce that this year did not disappoint."

"The revenues in our business's various divisions surpassed the previous year's recovery and pre-Covid times. Numbers don’t lie. AHG’s revenue in H1 of this 2022 vs 2019 grew by 19 per cent in revenues and 95 per cent in ebitda.

“This shows that we have the right strategy and positioning as a group and a country overall. With the ongoing turbulent market environment and geopolitical uncertainties, the United Arab Emirates is showing exceptional resilience due to the vision and policies set by its leadership and complemented by the local businesses,” he added.

.png)