The Abu Dhabi Investment Council more than tripled the size of its position in a Bitcoin exchange-traded fund during the third quarter, shortly before the bull market in cryptocurrencies gave way to a brutal selloff.

The firm, an independently-run unit of sovereign wealth fund Mubadala Investment Co., increased its holding in BlackRock Inc.’s iShares Bitcoin Trust ETF to almost 8 million shares as of Sept. 30, according to a regulatory filing. The position, disclosed by a subsidiary of ADIC, was worth about $518 million at the time. It held 2.4 million shares three months earlier.

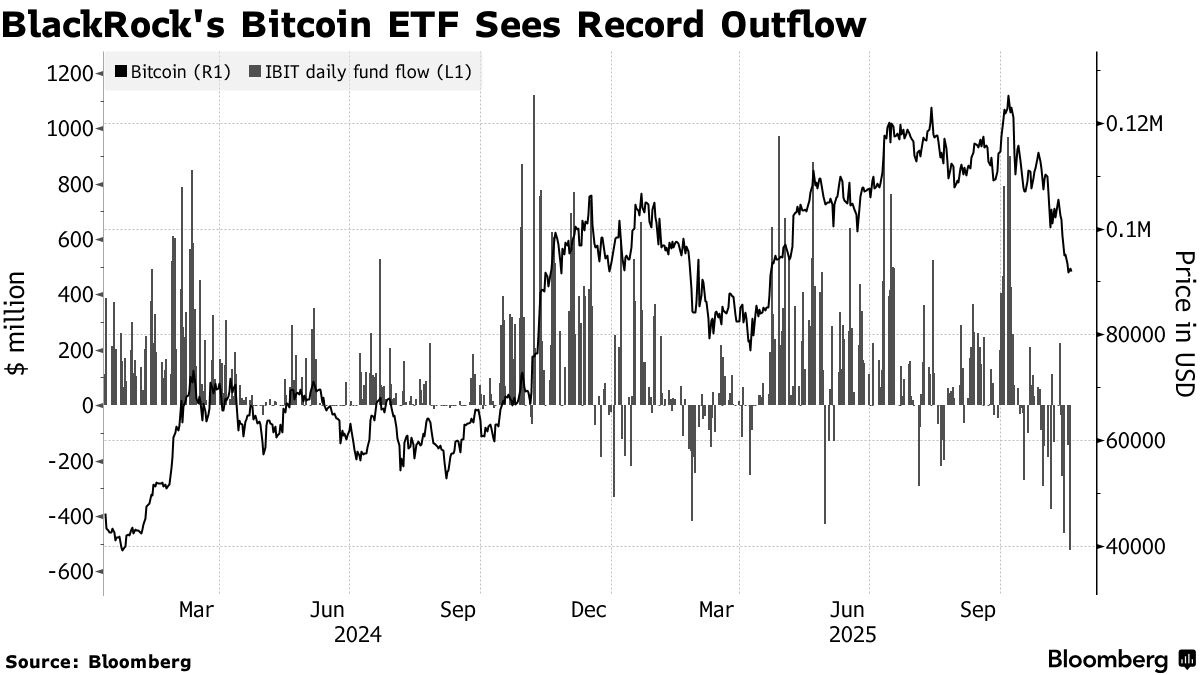

Bitcoin rallied to a record $126,251 in early October, driven partly by massive inflows into exchange-traded funds like the iShares Bitcoin Trust ETF, which is by far the world’s largest crypto ETF with more than $70 billion in assets. Then came a market crash sparked by liquidations of billions of dollars in leveraged bets that sent Bitcoin tumbling below $92,000.

The disclosures offer a rare detailed look into the strategy being pursued by ADIC, which invests mostly in private assets in areas like buyouts, infrastructure and real estate. A representative for ADIC said it’s building a small allocation to Bitcoin as part of a long-term diversification strategy.

“We view Bitcoin as a store of value similar to gold, and as the world continues to move toward a more digital future, we see Bitcoin playing an increasingly important role alongside gold,” the ADIC spokesperson said in response to Bloomberg News queries. “Both assets contribute to diversifying our portfolio, and we expect to hold them as part of our near and long-term strategy.”

Record Outflows

Mubadala separately disclosed that it owned 8.7 million shares valued at $567 million in the same Bitcoin ETF, known by its ticker symbol IBIT, at the end of the third quarter. That’s unchanged from its holding three months earlier.

Details on the purchase prices weren’t immediately available. IBIT — which tracks the value of Bitcoin — has lost about a fifth of its value since Sept. 30, after advancing 6.2% in the third quarter. It traded at a volume-weighted average price of $64.52 during the third quarter, Bloomberg data show.

ADIC wasn’t alone in adding to its position last quarter, with Harvard Management Co. also boosting its holdings in IBIT during that period.

But investors have pulled back overall as markets turned. So far in November, about $3.1 billion has been yanked from a group of 12 spot US Bitcoin ETFs including IBIT, data compiled by Bloomberg show. IBIT suffered a record $523 million in outflows on Tuesday, after Bitcoin dipped below a key price point that meant the average investor in US ETFs tracking the token was sitting on losses.

Abu Dhabi’s moves into the sector hold particular significance given its vast financial resources. The city’s wealth funds oversee more than $1.7 trillion, and Mubadala has already been a key driver of the emirate’s emergence as a global crypto hub in recent years.

Earlier this year, a technology investment firm jointly established by the $330 billion wealth fund bought a $2 billion stake in crypto exchange Binance. The fund, called MGX, did that deal using a so-called stablecoin issued by a company affiliated with the family of US President Donald Trump.

Mubadala absorbed ADIC a few years ago, though the two funds continue to operate separately. Initially set up in 2007, ADIC has been expanding its senior executive ranks as it seeks to step up global investments.

It recently hired Alain Carrier, the former chief executive officer of private markets firm Bregal Investments, as the executive director of its private equity business. Before his stint at Bregal, Carrier was the head of international business at Canada Pension Plan Investment Board.

ADIC has also hired Ben Samild, who was previously the investment chief of Australia’s A$252 billion ($164 billion) sovereign wealth fund, as its chief strategist.

ADIC adopts an endowment investment model, and focuses predominantly on private assets and, geographically, on North America. Its latest move indicates that global institutions — and even governments — are continuing to pile into crypto assets despite the sector’s notorious volatility.

El Salvador President Nayib Bukele, an early crypto advocate, made Bitcoin legal tender in 2021. The country added more than $100 million to its Bitcoin holdings this week.

The Czech central bank last week announced its first-ever purchase of cryptocurrencies, as officials seek to determine if digital assets have a role to play in diversifying reserves. The $1 million investment will be kept separate from the central bank’s official foreign reserves, it said.

And earlier in November, Kazakh central bank governor Timur Suleimenov told Bloomberg News that the country is building a national cryptocurrency reserve fund of as much as $1 billion, in part by using assets seized and repatriated from abroad.

No comments:

Post a Comment