Equities in Dubai advanced on Sunday amid optimism over a rebound in tourism, while the main index in Israel slumped. Saudi stocks gave up early gains, but are still on track to be the Middle East’s best performers in 2020.

Gauges in Dubai, Bahrain, Qatar and Egypt rose between 0.3% and 1%, while those in Saudi Arabia, Abu Dhabi, Kuwait and Israel slipped. The volume of shares traded in all markets was below the 30-day average ahead of the holiday season. The main index in Riyadh gained as much as 0.6% before ending 0.3% lower.

Positive sentiment prevailed in the Gulf as OPEC+ said it will react faster to changes and take a more hands-on approach with the oil market by starting regular monthly meetings. More frequent conferences mean policy makers in oil-producing countries will drive the market, not speculators, Saudi Energy Minister Prince Abdulaziz bin Salman said on Saturday.

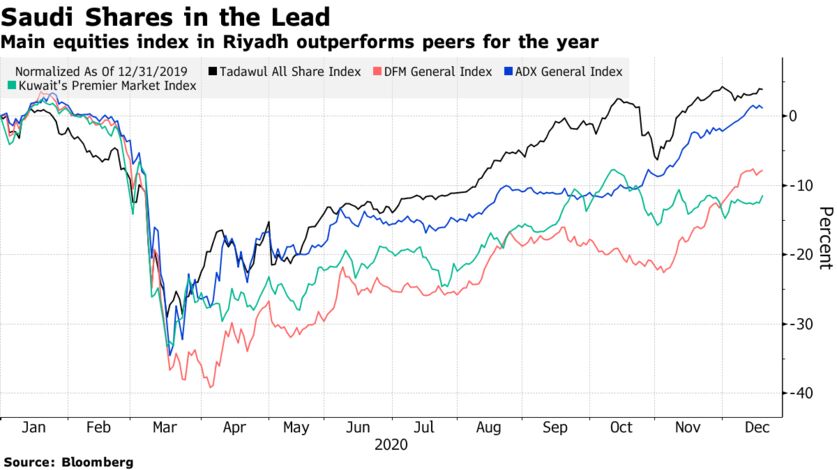

The Tadawul All Share Index is up about 4% in 2020, more than any other in the Gulf, despite a slump in the price of crude since the start of the pandemic. Saudi shares have been recovering amid optimism that vaccine rollouts will provide a long-awaited boost to oil demand. About 300,000 people have already registered to take the Covid-19 vaccine in the country.

Loose monetary policy in Saudi Arabia, high liquidity among investors, and companies taking steps to save cash to retain investors’ confidence helped boost the biggest stock market in the Middle East in 2020, according to Joice Mathew, head of equity research at United Securities in Muscat.

“After the initial hiccups and uncertainties related to low oil prices in April, investor sentiment was boosted in an unprecedented manner,” Mathew said. He added that a weaker dollar, stronger oil price and vaccine developments are “an excellent recipe for continuation of the investor confidence and momentum.”

No comments:

Post a Comment